If you’ve recently applied for a checking account and were turned down due to a negative banking history, chances are good that you’ve been flagged by ChexSystems. Approximately 85% of all banks in the country use ChexSystems when you apply for a new checking account. If you’ve experienced things like unpaid debts or involuntary account closures at another banking institution, odds are you’ve been reported to ChexSystems.

ChexSystems is supposed to act like a safety net for banks and in an effort to weed out people who have committed fraud or identity theft. However, many everyday people get caught in the crossfire and are flagged for lesser offenses, resulting in them being blacklisted by the majority of banks out there. It may be difficult to walk into any given institution and open a checking account. Our job here at CheckingExpert.com is to give you an up-to-date list of all the banks and credit unions in Utah that want your business.

Fortunately, a lot of banks and credit unions offer second chance checking accounts, which are designed for anyone who has experienced a few banking mishaps in the past. In addition, there are a lot of banks out there that don’t use ChexSystems at all during the application process. In fact, they may not even check your credit score when you apply for a new account!

No matter what your situation may be, you still deserve a second chance and a checking account that will benefit your life.

Second Chance Banking in Utah

Get an Account Today!

U.S. Bank | Earn Up To $700 Cash Bonus

U.S. Bank is the fifth largest bank in the country with the majority of its 2,000+ branches located in 26 states mostly located in the west and midwest.

You can earn up to $700 when you open a new U.S. Bank Smartly® Checking account and a Standard Savings account and complete qualifying activities. The offer is subject to certain terms and limitations and is valid through June 27, 2024. Member FDIC. Offer may not be available if you live outside of the U.S. Bank footprint or are not an existing client of U.S. Bank or State Farm.

U.S. Bank Smartly® Checking at a Glance

- A U.S. Bank Visa debit card

- Online banking and bill pay

- Mobile banking and mobile check deposit

- Send money with Zelle®

- 24/7 customer support

- No NSF charges for overdraft balances under $50

- Access to U.S. Bank Smart Rewards® to reap additional benefits

- No fees at U.S. Bank ATMs

- No surcharge fees at 40,000 MoneyPass ATMs

States Where U.S. Bank is Available

If you live in one of the following 26 states where this account is available, you can apply online: AR, AZ, CA, CO, IA, ID, IL, IN, KS, KY, MN, MO, MT, NC, ND, NE, NM, NV, OH, OR, SD, TN, UT, WA, WI, WY.

Account Details and Costs

To get an account, you’ll need to make an opening deposit of $25. The monthly service fee is $6.95 but can be waived if you maintain a minimum balance of $1,500 or by having a combined monthly direct deposit totaling $1,000. You can also avoid the monthly fee if you are 24 and under, 65 and over, or a member of the military (must self-disclose) or qualify for one of the four Smart Rewards® tiers (Primary, Plus, Premium, or Pinnacle).

Banking Made Easy

The U.S. Bank Smartly® Checking account comes with one of the best mobile apps on the market. Over one million customers have given the app an overall rating of five stars. You can manage your entire account from a computer or your smartphone.

And there’s more to U.S. Bank than an outstanding smartphone app: 24/7 customer service, Zelle® instant transfers, free budgeting and automated tools, overdraft leniency, and Smart Rewards®. Perhaps that’s why U.S. Bank repeatedly makes the list of one of the best banks in the country.

Open an account today!

Chime | Over 7 Million Active Users

Fast-growing Chime® is one of our favorite checking accounts. The account has some amazing features and Chime accepts almost all customers who apply… even if you have bad or poor credit or have been blacklisted by ChexSystems or the credit bureaus.

Chime at a Glance

- NO credit check or ChexSystems

- NO initial deposit required

- NO minimum balance required

- NO monthly or annual fees

- NO NSF/overdraft fees1

- NO foreign transaction fees

- NO fees at over 60,000 ATMs2

- NO fees for mobile and online bill pay

- FREE cash deposits at 8,500+ Walgreens3

- Get your paycheck up to 2 days early with direct deposit4

- 700,000+ 5-star reviews for the Chime smartphone app

- Instantly transfer funds to friends and family without additional apps5

- FDIC insured account up to $250,000

Savings Made Easy

Chime was one of the first to offer a “round up” option. If you use your Chime card on a purchase of $10.65, Chime gives you the option of automatically rounding up to $11.00 and putting the remaining $.35 in your free Chime savings account. And that adds up over time! Plus, Chime pays 2.00% Annual Percentage Yield (APY)6 in interest on that savings account.

We don’t think there is another company innovating for their customers like Chime.

Get a Chime Account Today!

Found Business Banking | Our Favorite Business Account

One of the biggest challenges for small businesses, entrepreneurs, and gig workers is finding the right bank account for their growing business.

The Found Business Banking Account solves that problem by simplifying your financial journey. Available only to sole proprietors and single-owner businesses, the sign-up process takes only a few minutes. There’s no credit check or ChexSystems.

Found Business Banking at a Glance

- No opening deposit required

- No minimum balance

- No required monthly fees

- Free unlimited ACH payments

- Free unlimited invoicing

- Free mobile check deposits

- Free built-in expense management tools

- Accept bank transfers and card payments

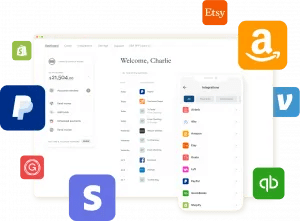

- Easily connect to Quickbooks, Stripe, Venmo, PayPal, Etsy, etc.

- Get paid up to 2 days early with direct deposit1

- Send money to anyone within the U.S. using their phone number or email address

- Deposit cash at over 79,000 locations

- Access your account online or on the free app

- Found’s core features are free. They also offer a paid product, FoundPlus

Fast Approval Process

Time is money and Found respects both. Apply for your business account onlineand the streamlined approval process ensures you’re up and running quickly. No lengthy paperwork needed to get swift access to your financial hub.

Easy Bookkeeping and Tax Management Tools

Managing your business finances shouldn’t be a headache. You get intuitive tools such as automated expense tracking, receipt capture, unlimited custom invoices, and the ability to manage 1099 contractor payments. Plus, you get the ability to auto-save for tax payments and automatically generate tax forms.

No Hidden Fees, No Surprises

Say goodbye to unexpected charges. Found.com believes in transparency. They’ve stripped away unnecessary fees, leaving you with a straightforward banking experience. No hidden costs—just clarity and peace of mind.

Found is a financial technology company, not a bank. Business banking services are provided by Piermont Bank, Member FDIC.2

Open a Found account now!

Upgrade Rewards Checking Plus

Upgrade is a digital banking platform providing a range of financial services, including checking accounts, personal loans, and credit cards without annual fees.

Upgrade Rewards Checking Plus at a Glance

- Up to 2% cash back on purchases

- NO opening deposit required

- NO monthly maintenance fees

- NO minimum balance requirement

- NO NSF or overdraft fees

- Get paid up to 2 days early with direct deposit

- 10%-20% lower interest rates on loans & credit cards through Upgrade

- Earn up to 5.21% APY with a free Performance Savings Account

- FDIC insured account up to $250,000

Earning 2% Cash Back

The Upgrade Rewards Checking Plus lets you earn 2% cash back rewards with debit card purchases. Eligible expenses include:

- Convenience and drug stores

- Gas stations

- Monthly subscriptions, including streaming services

- Restaurants

- Utilities and cellphone services

All other purchases will earn 1% cash back. To earn the reward your account must be “active”. An active account is one that has a monthly direct deposit of $1,000 or more.

But if you choose not to or cannot meet the monthly direct deposit requirement, the account cashback program is reduced from 2% to 1%. In our view, that’s still a very strong offering with very few fees.

Consumers Love Upgrade

Managing your transactions is effortless, facilitated through either an intuitive online dashboard or the convenient Upgrade mobile app, available for both iOS (4.8 out of 5 rating) and Android (4.7 out of 5 rating) users. You’ll also have free access to your credit score and will be notified of any changes.

Not only is the Upgrade Rewards Checking Plus one of our favorites, but the account also has very high approval rates.

Get an Upgrade Account Now!

Current | Build Credit While You Bank

Current offers an innovative account to consumers who want it all without the costs and hassles.

The Current Build account works just like a checking account but also helps you build credit every time you use the card. Sign-up takes about 2 minutes and Current has extremely high acceptance rates.

Current at a Glance

- NO credit check

- NO minimum balance

- NO deposit required to open an account

- NO fees at over 40,000 ATMs in the U.S.

- Get your paycheck up to 2 days early with direct deposit

- Earn 4.0% APY on your balance up to $6,000 with direct deposit; earn 0.25% APY without

- Earn points for unlimited cashback at participating retailers

- Send money instantly for free

- An elegant but simple smartphone app

- 24/7 member support

- FDIC insured account up to $250,000

Swipe The Card and Build Credit

Using your Current Build account to BUILD your credit is simple. Here’s how it works:

- You add money to your account

- Swipe your card to make purchases, pay bills, or get money from an ATM machine

- The funds in your account pay for these transactions

- Current reports your payment to build your credit history

Current Works Hard for You

Current offers a really unique service it calls Gas Hold Removals. What’s a gas hold? Some gas stations may apply a hold from $50 to $100 when you use your card to pump gas. If you only pumped $10 of gas, but the gas station places a $100 hold on your funds, you won’t have access to the $90 difference for up to 3 business days! The Current Build card will immediately refund the hold so you have access to all your funds. We haven’t found that benefit anywhere in the marketplace.

We love the features, we love the smartphone app, and we love Current. That makes us think you’ll love them too.

Get a Current Account Now!

Chase Secure Banking | $100 New Account Bonus

Most people know Chase and with over 15,000 ATMs and 4,700 branches across the country, the Chase Secure Banking account might be a good fit for a second chance bank account.

Chase Secure Banking at a Glance

- NO credit check

- NO ChexSystems

- NO minimum deposit to open

- NO overdraft fees

- FREE access to over 15,000 Chase ATMs

- FREE Chase OnlineSMBill Pay

- FREE money orders and cashier’s checks

- Quickly send and receive money with Zelle®

- Paper checks are not offered with the account

Earning the $100 Bonus

To earn the $100 bonus, you’ll need to complete 10 qualifying transactions within 60 days of account enrollment. Qualifying transactions include debit card purchases, online bill payments, Chase QuickDepositSM, using Zelle®, or receiving ACH credits.

What to Know About the Approval Process

Chase Secure Banking is the only account offered by Chase that doesn’t use ChexSystems but does use Early Warning Services (EWS). Additionally, if you’ve had an account closed by Chase in the past, your application will not be approved. Past account closures can include missteps such as non-payment of fees, excessive overdrafts, or suspected fraud.

Fees

Chase doesn’t offer overdraft services with this account as you can only spend the money you have available. You should also know that using non-Chase ATMs can cost from $3.00 to $5.00 per transaction. Surcharges from the ATM owner/network may apply.

Chase Secure Banking carries a $4.95 monthly service fee, but it can be waived when you have electronic deposits made into the account totaling $250 or more during each monthly statement period.

Other Account Features

Chase Secure Banking offers several other features we like. This includes:

- Zero Liability Protection. Get reimbursed for unauthorized debit card transactions when reported promptly.

- Budgeting Tools. Manage your spending and get daily spending insights with Snapshot in the Chase Mobile® app.

- Credit and Identity Monitoring. Track your credit score, get a personalized action plan provided by Experian™ to help improve your score and receive identity monitoring for free through Chase Credit Journey®.

- Early Direct Deposit. Get that “just paid” feeling up to two business days sooner with early direct deposit.

If you’ve wanted to bank with Chase and wondered if you’d qualify, we think you’ll be happy with the Chase Secure Banking account.

Get a Chase Account Now!

Acorns

Acorns is making a name as a place to invest money for the long term, but what we really like is that they offer both checking and savings accounts. That makes Acorns another of our favorite bank accounts. As a company built to compete with the largest banks, Acorns offers some extraordinary benefits.

We love the heavy metal tungsten Visa debit card and the world-class smartphone app that allows you to manage every aspect of your new checking account such as budgeting, spending, and security.

Another nice option is the ability to round up on every purchase and Acorns will take that money and automatically put it in a savings account. This really helps build a nest egg.

It takes about 2-3 minutes to sign up and not only do you get a checking and savings account, but you also have access to an investment account once you’re ready to consider that. And, it’s free. Here’s more:

- FREEVisa® debit card

- FREE bank-to-bank transfers

- FREE physical check sending online or through the mobile app

- FREE mobile check deposits

- FREE access to 55,000+ fee-free ATMs

- NO minimum balance or overdraft fees

- NO credit check

- $3 monthly fee

- FDIC insured

Acorns was built to give everyone the tools to manage their finances which makes it one of our top picks.

Get an Acorns Account!

Ally Bank Spending Account

Ally Bank has been one of the most highly rated online banks for the past several years. It’s not because they have the most features, but because they consistently make their customers delighted with the features the bank offers.

For starters, there’s no minimum opening deposit required. Ally doesn’t charge any monthly maintenance fee and there is no overdraft fee (more on that below). You’ll have access to 43,000+ ATMs and Ally will reimburse you up to $10 per statement cycle if you get charged for using another institution’s machine.

You’ll become eligible for Ally’s overdraft program called CoverDraft 30 days after depositing a total of $100. Ally will activate CoverDraft automatically and send you an email when they do. You can turn CoverDraft off at any time, as long as your account balance isn’t negative. Otherwise, Ally will decline the transaction without payment. In either case, you won’t be charged an overdraft fee.

We like that you can use Zelle to send and receive money, get paid up to 2 days sooner with early direct deposit, and deposit checks remotely with Ally eCheck Deposit. We also like that Ally has high approval rates as long as you don’t have a ChexSystems or EWS fraud alert in your past.

Apply for an Ally Account Today!

American United Federal Credit Union

If you’ve had past issues with managing a checking account or have a less-than-perfect financial standing, American United Federal Credit Union offers a solution. With their Fresh Start Checking account, you will be able to re-establish a positive banking history.

If you’ve had past issues with managing a checking account or have a less-than-perfect financial standing, American United Federal Credit Union offers a solution. With their Fresh Start Checking account, you will be able to re-establish a positive banking history.

The account comes with most features that you’d find in a traditional account including a Visa debit card, mobile deposit services, and overdraft protection options. To open the account, you will need $20 for an initial deposit and $7 for the monthly service charge. If you keep a balance of $750 or more, that service charge will be reduced to $4.

You can apply for the account online or apply in person at one of their many branches. You can find them in West Jordan, Salt Lake City, Sandy, West Valley City, Grantsville, and Sunnyside.

Cyprus Credit Union

Cyprus Credit Union offers their Fresh Start Checking account to those that have been reported to ChexSystems and are having difficulties getting a checking account. If your ChexSystems record is older than a year and you have no more than 2 items on your record totaling less than $500, you qualify for the account.

Cyprus Credit Union offers their Fresh Start Checking account to those that have been reported to ChexSystems and are having difficulties getting a checking account. If your ChexSystems record is older than a year and you have no more than 2 items on your record totaling less than $500, you qualify for the account.

To open a Fresh Start Checking account, an initial deposit of at least $25 is required. It’s important to note that direct deposit is also required with this account. For a low $5 monthly service fee, you’ll get access to a Visa debit card and access to online banking. We like this account because it allows you to upgrade to one of their other checking options after 12 months of responsible use.

There are a multitude of ways to become a member at Cyprus CU. If you’re not eligible based on where you live or work, you can make a one-time $5 donation to establish your membership. To see if their a good fit for you, visit their website or one of their branches in cities including West Valley, Salt Lake City, Centerville, Draper, Riverton, and many others.

Desert Rivers Credit Union

If you’ve had previous issues with ChexSystems or the credit agencies, we recommend Desert Rivers Credit Union. They do not run ChexSystems or pull a credit report when you apply for an account.

If you’ve had previous issues with ChexSystems or the credit agencies, we recommend Desert Rivers Credit Union. They do not run ChexSystems or pull a credit report when you apply for an account.

We recommend their Free Checking account because it comes with all of the basics while avoiding unnecessary service fees. The account includes a free Visa debit card, online bill pay services, and overdraft protection services. You won’t have to worry about any monthly service fees, per-check charges, or minimum balance requirements.

Desert Rivers CU offers membership to those that live in Grand, San Juan, and Green River Counties. If this sounds like a good fit for you, visit their website or one of their branches in Moab, Green River, Blanding, and Monticello to get started!

Discover Bank® Cashback Debit Checking Account

No. Fees. Period. That’s how Discover Bank promotes its Cashback Debit Checking Account. And, after conducting our research, we can say that’s mostly true. In fact, the only fees you’ll ever incur are for outgoing wire transfers and service charge fees if you use a non-Discover ATM if it is not part of the 60,000+ ATMs in their no-fee network.

As long as there are no past incidences of fraud on your ChexSystems report, Discover might be a great account for you. The only negative? There is no way to deposit cash directly into the account.

Discover Bank® Cashback Debit Checking Account at a Glance

- 1% cash back on up to $3,000 in debit card purchases each month

- Access to 60,000+ fee-free ATMs; $510 cash withdrawal limit per day

- Fee-free opt-in overdraft protection transfer service

- Get paid up to 2 days early with direct deposit

- Send and receive money with Zelle®

- No monthly fee (no balance or activity requirements)

- No fee for insufficient funds

- Mobile check deposits

- No deposit to open

Learn More

GO2bank

GO2bank is an offering of pre-paid card giant GoBank and we think it’s a step in the right direction. Like some of the newer “challenger banks” GO2bank will deposit your direct deposit check up to 2 days early and has cashback rewards on several categories of purchases. This account also makes you eligible for the GO2bank secured credit card, which has no annual fee and no credit check.

One significant drawback to many online-only bank accounts is that they have no way to accept cash deposits. But GO2bank accepts cash deposits at over 90,000 Green Dot locations nationwide. However, participating retailers may charge you a fee.

If you direct deposit over $500, your monthly maintenance fee of $5.00 is waived. And, they offer a pretty sweet overdraft protection program, but it has a gotcha charge of $15 if you don’t replace the funds within 24 hours.

Account-holders will appreciate the ability to budget their money with the help of a mobile app, budgeting tools, and a savings vault. In fact, they pay 4.50% on all money in the savings vault up to $5,000.

Learn More

GTE Financial

Go Further from GTE Financial helps put you on the path to a better checking account. If you don’t qualify for a traditional account, the Go Further account will help you get there in as little as 12 months. We consider this a low-cost second chance checking. As long as you make a total deposit of $500 for the month, opt to receive eStatements and make 15 monthly transactions, the $9.95 maintenance fee is waived.

GTE Financial is one of the largest credit unions in the US. Membership is open to anyone through easy requirements and an online application process. The Go Further account includes:

- Free EMV-equipped debit card with built-in rewards

- Online and mobile banking tools

- Free bill pay service

- Easy money transfers through the Popmoney service

Learn More

Lili | Quick Approval Small Business Banking

Lili was custom made for freelancers and independent contractors who are operating as sole proprietors and single member LLCs and we really like their offering. Lili aims to approve most accounts within 2-3 days, but some accounts are approved in 2-3 hours.

Lili offers a checking account and Visa debit card with no initial deposit or minimum balance requirement, no hidden fees, no credit check, and no ChexSystems. Lili makes getting your account easy!

Lili at a Glance

- FREE business VISA debit card

- FREE (and very user-friendly) mobile app

- NO minimum balance

- NO NSF charges or fees

- NO credit check or ChexSystems

- NO fees for incoming wire transfers

- Receive direct deposit funds 2 days earlier than many banks

- Mobile check deposit

- Unlimited fee-free transactions

- Takes 3 minutes to apply

Application Process

You can set up an account online. If you’re a freelancer, you should receive approval and account access almost instantly. All others (Sole Proprietor, Single-Member LLC, Multi-Member LLC, General Partnership, Limited Liability Partnership, or S Corp) can take a couple of days to get approved. You can fund your account using a mobile check deposit, direct deposit, ACH transfer, or by linking your Venmo, PayPal, or Cash App account.

Open a Lili account now!

mph.bank Fresh Account

It’s a tall order to “Make People Happy” when it comes to banking, but that’s the stated mission behind mph.bank.

Powered by Liberty Savings Bank (established in 1889!), the mph.bank Fresh account does use ChexSystems, but as long as you don’t have more than 3 charge-offs totaling $1,000 or reports of fraud approval rates are very high. Fees for the account include a $9 monthly service fee and a $10 overdraft fee.

mph.bank Fresh Account at a Glance

- $0 initial deposit to open account

- Send and receive money with Zelle®

- Access your account with your phone or computer

- When coupled with a free savings account, earn up to 5.00% APY

- Optional ability to round up charges and stash the cash into savings

- Get paid up to 2 days early with direct deposit

- Access to over 55,000 fee-free ATMs

Apply for a Fresh Account Today!

Navy Federal Credit Union

No matter your banking past, Navy Federal Credit Union offers traditional checking for all members in Alabama and across the US. With no review requirements of your banking history, NFCU is an excellent choice for active duty or retired US military, family members and government contractors. There are two banking choices to choose from: Active Duty Checking and Free eChecking.

Both account options come with a free NFCU debit card. There is no monthly service fee with direct deposit. Your account is protected from overdrafts with free savings transfers, a checking line of credit or an optional overdraft protection service. You also receive:

- Free mobile deposits

- Free bill pay

- Free traditional name-only checks

- Dividends credited monthly

Learn More

NorthOne | No ChexSystems Small Business Banking

NorthOne is a fast-growing company built specifically around business banking solutions for freelancers, entrepreneurs, and small business owners. In addition to dramatically streamlining the application process, NorthOne doesn’t check your credit and doesn’t use ChexSystems. Here’s a recap:

- FREE business Mastercard debit card

- FREE access at over 1,000,000 ATMs nationwide

- FREE online and mobile app

- FREE live chat (not a chatbot), telephone, or email support

- FREE in-app invoice creator

- NO minimum monthly balance requirement

- NO NSF fees

- NO ACH transfer fees

- NO credit check or ChexSystems

Banking Services

NorthOne doesn’t require a minimum account balance and charges a $10 monthly fee that includes unlimited transactions in your account. These include ACH payments, bill pay, debit card usage, mobile deposits, and transfers. The only other fee is $15 for wire transfers.

You can also grant read-only access to employees or your accountant or bookkeeper. This keeps your account safe while also giving access to those who need it.

Integrations

With NorthOne business banking, you can connect your account to an almost unlimited number of third-party apps. NorthOne integrates with business tools including Paypal, Stripe, Square, Etsy, Shopify, Airbnb, Amazon, Venmo, Toast, Uber, Lyft, Quickbooks, FreshBooks, Wave, Expensify, and many more. Through these integrations, you can sync transaction details, collect payments, see and pay invoices, send payroll, pay contractors, and more.

With NorthOne business banking, you can connect your account to an almost unlimited number of third-party apps. NorthOne integrates with business tools including Paypal, Stripe, Square, Etsy, Shopify, Airbnb, Amazon, Venmo, Toast, Uber, Lyft, Quickbooks, FreshBooks, Wave, Expensify, and many more. Through these integrations, you can sync transaction details, collect payments, see and pay invoices, send payroll, pay contractors, and more.

If creating and sending invoices, quotes, and estimates is critical to your business, NorthOne offers a free stand-alone invoice creator that integrates seamlessly with the banking app. We’ve tried it and think it’s an elegant solution.

Envelopes

NorthOne has created a feature that helps you plan for and manage important expense categories. They call these sub-accounts “Envelopes” and you can set up as many as you want. This allows you to set aside funds you know you’ll need in the future such as taxes or payroll. You can set custom rules for your envelopes and easily move money back and forth as needed.

Application Process

NorthOne targets account approvals within one to two business days. Information required to open an account includes name, address, and social security number or tax identification number. If applicable, NorthOne may ask for a copy of your business license and business formation documents. After you’re approved, you’ll need to make a $50 minimum opening deposit.

NorthOne is one of the most competitive business bank accounts for entrepreneurs and small business owners. Their combination of services and offerings, the fast application process, and customer support create an outsized competitive advantage for both the bank and its customers. Every small business owner understands how critical that is for success.

Open an account today!

Rate The Information on This Page

SoFi Checking & Savings | Earn a $325 Welcome Bonus

The account is offered by SoFi Bank. It’s a checking AND savings account and we love that. Plus, they don’t use ChexSystems or your credit report to approve accounts.

SoFi Checking & Savings at a Glance

- FREE SoFi debit MasterCard

- FREE smartphone app. Manage your account online, too

- No opening deposit required

- No monthly minimum balance requirement

- No monthly maintenance fees

- No fees at 55,000+ ATMs

- Get paid up to two days early with direct deposit

How to Earn the $325 Bonus

As soon as you get your SoFi Checking & Savings account and deposit $10 or more, you’ll earn $25. When you set up direct deposit from an employer, SoFi will credit your account up to an additional $300 (depending on the amount of your direct deposit).

Using the SoFi direct deposit option unlocks additional benefits, too. First, if you overspend a bit, SoFi will cover up to $50 with no overdraft fees. Second, you’ll receive a much higher interest amount of 4.60% APY on savings account balances and .50% APY on checking account balances. If you decide not to utilize direct deposit, you’ll receive 1.20% APY on savings balances.

The sign-up process can take less than 60 seconds. With over 6 million members, SoFi is a bank you can count on!

SoFi has been great! The account was easy to open and I got my debit card a few days later. The smartphone app is easy to use and I can check everything from my computer, too. SoFi seems to be the perfect bank.

Claire M., SoFi Customer

Get a SoFi Account Now!

Varo Bank

Varo Bank is another internet-only bank with services based on their mobile apps for Apple and Android devices. Varo doesn’t charge fees at 55,000+ Allpoint ATMs and offers strong budgeting tools and automatic savings programs.

Opening an account is easy and Varo doesn’t check your credit or use ChexSystems. Varo doesn’t even require an initial deposit to open an account, either. There are never any monthly maintenance fees, account balance minimums, overdraft fees, foreign transaction fees, transfer fees, or debit card replacement fees.

Varo’s recent bank charter has them innovating more than ever. They have a very strong cashback program, a payroll advance option, and have started to offer their customers a secured credit card called Varo Believe.

Finally, if Varo receives a payroll notification before your payday, it can deposit your money more quickly than many banks.

Get a Varo Account Now!

Walmart MoneyCard

Want to earn cash back on Walmart purchases – up to $75 each year? Then you might love the Walmart MoneyCard.

It’s a debit card that has some strong features such as cashback on Walmart purchases, overdraft protection, interest on your savings, and a mobile app that lets you track your purchases and deposit funds into your account.

Our favorite features include:

- Easy approval: no ChexSystems or credit check

- No initial deposit is required and there are no monthly minimums

- Deposit cash for free at any Walmart store and it shows up 10 minutes later

- Deposit checks using the Walmart MoneyCard smartphone app

- Easily request multiple cards for family use1

- Manage your account from your computer or the smartphone app

- 3% cashback on Walmart.com purchases, 2% cashback for Walmart fuel stations, and 1% cash back for use in-store2

- Earn 2.00% APY on money you set aside in a free savings account3

- With qualifying direct deposits4, you can opt-in and enjoy overdraft protection of up to $200 on eligible purchases5

- No monthly fee when you direct deposit $500+ in the previous monthly period. Otherwise, there’s a $5.94 monthly fee.6

The Walmart MoneyCard is available in all 50 states, Washington D.C., and Puerto Rico.

Get a Walmart MoneyCard Account Now!

Wells Fargo

Wells Fargo recently changed the Opportunity Checking account to Clear Access Banking. And we like one change, in particular. Wells Fargo has done away with overdraft and non-sufficient funds (NSF) fees. Clear Access Banking is a debit card-only account (no paper checks available) and if you attempt to purchase something without sufficient funds, the transaction will be denied. That’s a lot better than having the transaction approved and then discovering you’ve been hit with a $35 overdraft fee.

There is a $5 monthly fee, but that is be waived for account holders 24 years old and younger. This account is available to residents in all 50 states.

- The largest number of branches in the U.S.

- Minimum deposit of $25 to open an account

- Online bill pay and smartphone app

- Mobile check deposit

- Includes a Visa debit card

- Send and receive money through Zelle

- Additional features include account alerts, 24/7 fraud monitoring, and zero liability protection for your debit card

Learn More

Citibank Access Checking

The Citi® Access Checking account is a solid option if you’ve been blacklisted by ChexSystems or Early Warning Systems. As long as you haven’t been flagged for fraudulent behavior and don’t owe Citibank an outstanding amount, approval rates for this account are good.

There are no monthly service fees for the first 3 months after opening the account. The $5 monthly service fee can easily be waived after that time by depositing at least $250 per month.

We also like that there are no overdraft or returned item fees because if you don’t have enough money in your account, the item will be returned.

Citibank Access Checking at a Glance

- 65,000+ fee-free ATMs

- Send money to almost anyone with a U.S.-based bank account through Zelle®

- No overdraft or NSF fees

- $5 monthly fee can be waived with $250 in qualified direct deposits

- $0 liability for unauthorized charges

- Available in all 50 states and Washington DC

- No minimum opening deposit

Apply for an Citi Account Today!

Capital One 360 Checking

The Capital One 360 Checking Account uses a proprietary approval process that does not include ChexSystems and might be a solid option for those who have had past financial challenges.

Available in all 50 states and the District of Columbia, Capital One acts more like an online bank than one with over 400 branches in a few states. Its highly-rated smartphone app gives customers full control of their account and you can access everything from a computer, too.

Capital One 360 Checking at a Glance

- No opening deposit is required

- No monthly or annual fees

- No minimum balance and no overdraft fees

- Add cash to your account at CVS® locations.

- No-fee access to over 70,000 ATMs nationwide

- No foreign transaction fees when traveling abroad

- Deposit checks and pay bills with the smartphone app

- Send and receive money with Zelle®

- Early direct deposit feature

- Monitor your credit score with Capital One’s CreditWise feature

- FDIC insured account up to $250,000

How The Overdraft Feature Works

The account offers two overdraft services. The first is a free savings transfer where you link your checking account to a savings account. If you overdraw from your checking account, Capital One will cover the charge by making a transfer from your savings account.

The second option is a no-fee overdraft where the bank approves recurring debit payments, check payments, or bill pay payments even if it results in a negative balance for your account. To qualify, you’ll need to receive at least $250 in direct deposits during two of the three previous months.

Customer Service

In the era of chatbots and customer service-by-email, Capital One stands out for its personalized customer service. Once you set up an online account, you can chat 24/7 with a live customer service representative. If you want to speak with a representative on the phone, you can call between 8 a.m. and 11 p.m. Eastern Time.

The website is laid out well and easy to understand. The smartphone app is also easy to navigate and has received 4.9 out of 5 stars in the Apple store and 4.6 out of 5 stars in the Google Play store.

Get a Capital One Account Now!

Did we leave your financial institution off this list of The Best Second Chance Banking in Alabama? Has there been a change in any of the listings? Please let us know.

Best Second Chance Banks by State

To find more information and additional options available in your area, select your state from the list below and explore your options.

Additional Chime Disclaimers: Back to Chime Review

Chime is a financial technology company, not a bank. Banking services and debit card issued by The Bancorp Bank, N.A. or Stride Bank, N.A.; Members FDIC. Credit Builder card issued by Stride Bank, N.A.

1Eligibility requirements apply. Overdraft only applies to debit card purchases and cash withdrawals. Limits start at $20 and may be increased up to $200 by Chime. See chime.com/spotme.

2Out-of-network ATM withdrawal fees may apply except at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM. Cash deposit or other third-party fees may apply.

3Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

4Customers are limited to three $1,000 cash deposits at Walgreens each day and $10,000 each month.

5Sometimes instant transfers can be delayed. The recipient must use a valid debit card to claim funds. Once you are approved for a Chime Checking Account, see your issuing bank’s Deposit Account Agreement for full Pay Anyone Transfers details. Please see the back of your Chime debit card for your issuing bank. See Terms and Conditions.

6The Annual Percentage Yield (“APY”) for the Chime Savings Account is variable and may change at any time. The disclosed APY is effective as of September 20, 2023. No minimum balance required. Must have $0.01 in savings to earn interest.

7Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

Additional Walmart MoneyCard Disclaimers: Back to Walmart Review

1Family Accounts: Activated, personalized card required. Other fees apply to the additional account. Family members age 13 years and over are eligible. Limit 4 cards per account. See Deposit Account Agreement for details.

2Cash back, up to $75 per year, is credited to card balance at end of reward year and is subject to successful activation and other eligibility requirements. Redeem rewards using our website or app. You will earn cash back of three percent (3%) on qualifying purchases made at Walmart.com and in the Walmart app using your card or your card number, two percent (2%) at Walmart fuel stations, and one percent (1%) on qualifying purchases at Walmart stores in the United States (less returns and credits) posted to your Card during each reward year. Grocery delivery and pickup purchases made on Walmart.com or the Walmart app earn 1%. For the purposes of cash back rewards, a “reward year” is twelve (12) monthly periods in which you have paid your monthly fee or had it waived. See account agreement for details.

3Interest is paid annually on each enrollment anniversary based on the average daily balance of the prior 365 days, up to a maximum average daily balance of $1,000, if the account is in good standing and has a positive balance. 2.00% Annual Percentage Yield may change at any time before or after account is opened. Annual Percentage Yield is accurate as of 3/1/2022.

4Direct Deposit: Early availability of direct deposit depends on timing of payroll’s payment instructions and fraud prevention restrictions may apply. As such, the availability or timing of early direct deposit may vary from pay period to pay period. Make sure the name and social security number on file with your employer or benefits provider matches what’s on your Walmart MoneyCard account exactly. We will not be able to deposit your payment if we are unable to match recipients.

5Opt-in required. $15 fee may apply to each eligible purchase transaction that brings your account negative. Balance must be brought to at least $0 within 24 hours of authorization of the first transaction that overdraws your account to avoid the fee. We require immediate payment of each overdraft and overdraft fee. Overdrafts paid at our discretion, and we do not guarantee that we will authorize and pay any transaction. Learn more about overdraft protection.

6No monthly fee with qualifying direct deposit, otherwise $5.94 a month. Waived when $500+ is loaded in the previous monthly period. First monthly fee occurs upon first use, the day after card activation or 90 days after card purchase, whichever is earlier.